News and Views – Jon Shaw, CEO

Moneysoft made more big strides forward in the September quarter, with the new mobile applications progressing to working prototype stage, Yodlee Open Banking capability integrated into the system, the Personal-to-Advice lead generation channel finalised and some great improvements on the XPLAN and Midwinter integrations completed.

New Mobile Apps

The build-out of the new mobile apps is progressing to schedule, and we are on track to get those completed and released by late-December or early January. Our development team has reached the stage of “working prototype” for the Android mobile app, with user registration, full account linking (including properties) and transaction management completed. The last tough piece to include is the Budget and Goals which is underway now. Once we have the Andriod app developed, we will commence testing while our development team moves straight on to the iOS app build.

Open Banking

More upgrades! You might not have realised it (that was our intent), but we have executed a major upgrade of the back-end aggregation system with Yodlee which enables collection of end user data via Open Banking channels. However, because Australia’s CDR regime is so regulation heavy, we will begin our Open Banking journey in the USA – starting in November this year. This will at least give us some expertise and experience of the Open Banking user flows and data quality, which we’ll be able to apply to the Australian system once we’ve jumped through the (very costly) hoops imposed by the ACCC.

Starting in November, you will see the first stages of this migration through a completely new means of linking and managing financial account data feeds within Moneysoft. We’ll be sure to notify everyone when this initial stage is completed.

Macquarie Bank Data Feed

I know that the actions of Macquarie Bank to (without notice) cut off screen-scraping by Yodlee and other data aggregators has been a major concern and headache for many of you. Interestingly, we have independently confirmed that username/password sharing and screen-scraping aggregation via Illion (bankstatements.com.au) is still allowed by Macquarie Bank. Call me cynical, but this is most likely because Illion is a major component of automated loan applications in Australia. Why Macquarie does not allow the same type username/password sharing access to Yodlee, Basiq and other data aggregators is an open mystery. For my part I have been in contact with Macquarie Bank (as has Yodlee) but we have not managed to get any joy from this, or even a sunset window during which we can make the switch from screen-scraping to Open Banking. I am not giving up on this issue…but I can say that Macquarie Bank have not demonstrated any genuine interest to help the situation and there doesn’t appear to be any prospect of them doing so voluntarily.

Personal-to-Advice Lead Generation

Over time it has become apparent to me that we allow a great volume of opportunity to fly past our window without taking advantage. As you all know, Moneysoft is first-and-foremost a business-to-business software provider. However, we do have a Personal offering that gains a reasonable amount of interest with no advertising or promotion at all. So we’re making an attempt to combine these to the advantage of everyone by allowing select Moneysoft Partners (Business Account subscribers) to promote their advice, money management and wealth building services to our Personal users. We will run a pilot of this with our first over the November to January period to see if it has legs and determine how we can make this part of our standard operating model.

What’s New and Shiny in Q3 – Miles Casbier, Product & Program Manager

Some of the significant enhancements that we implemented and released into the software during the September quarter…

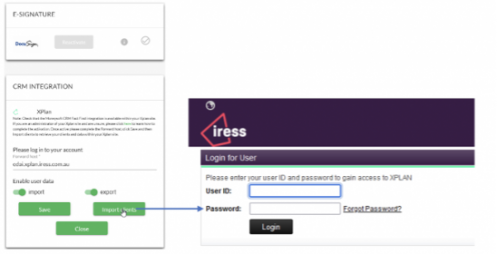

Xplan and Midwinter Integrations – A number of improvements were made to the authentication and data synchronisation between Moneysoft-Xplan and Moneysoft-Midwinter. The integrations and data sync are now working quite seamlessly across standard or 2FA authentication methods.

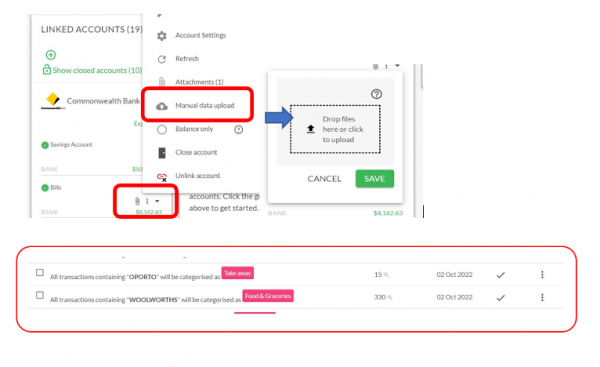

Rules now apply to Manual Transaction Uploads

Transaction recategorisation rules will now automatically apply to manual transaction uploads.This is especially useful if you have clients with financial institutions that cannot be linked (e.g. Macquarie Bank – see below) or if you would like to upload transactions for new clients extending beyond the intial transaction retrieveal period (4 months).

Manual transactions can be uploaded via a CSV file to either a manually created account or to an account that is linked via Yodlee.

Financial Health Check and Gap Report now available for all User Types – The Financial Health Check was made available to all users, meaning it is no longer strictly tied to Wealth Track clients. We also enhanced some of the outputs including the colour-coding, messages and information in both the Health Check Report and the associated Gap Report (for Advisers only). If you haven’t seen this great tool before, it’s time to check it out.

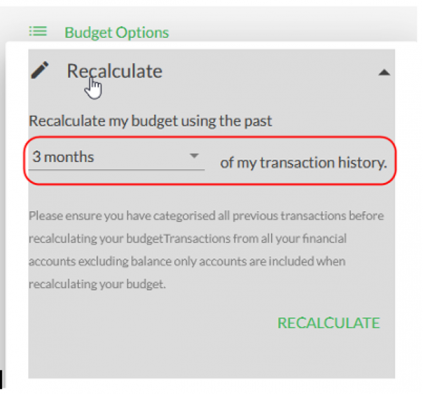

Four Months of Transaction History on initial Account Linking – We expanded support for longer periods of transaction history and extended the transaction history we retrieve when financial accounts are first linked. We now ask for up to four (4) months of historical transaction data, which provides a more accurate understanding of historical cash flow and increases the accuracy of the initial auto-calculated budget.

Performance Improvements – Further performance improvements were made covering background data collection and processing, as well as categorisation rules processing. We are definitely seeing a difference in our performance monitoring data and we hope you’re noticing some improvements too.

In Case You Missed It…

A number of other minor enhancements have also been implemented over the past three months. So, in case you missed those, you can find every single Release Notes announcement, containing a full list of improvements and enhancements, in the Biznews Hub.

Quick Tips n Tricks – Victoria Cougan, Customer Care Manager

Historical Budget Data

Due to the internationalisation of Moneysoft, there are some challenges around time and the way time-zones are handled. Explaining this is akin to reading The General Theory of Relativity (almost) so all we will say is, if you do see something amiss in your historical Budget v Actual reports, contact us and we’ll help you fix it!

Macquarie Bank Data Feed

The best way to get Macquarie Bank data into clients’ Moneysoft accounts now is to use the Manual Data Upload feature for any linked Macquarie Bank account. Alternatively, you might consider shopping with your feet!

Posted 3 years ago by Moneysoft Sales 6 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more