1. Budget Analysis Tool

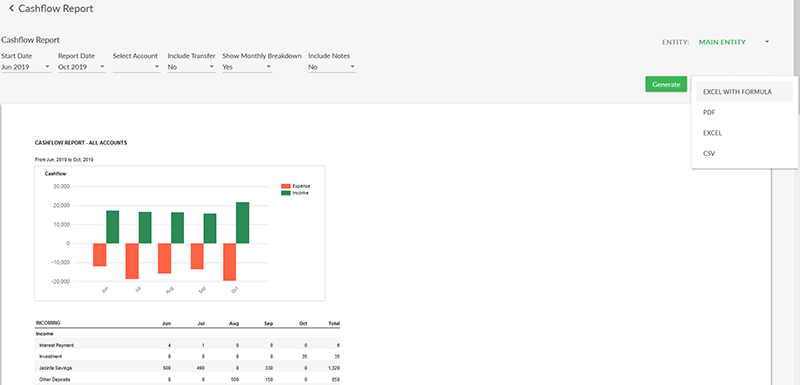

The first phase of a new Budget and Cashflow reports export tool has been released, allowing these to be exported to Excel with the formula intact.

These new feature will allow Advisers and Clients to open these reports in excel and update the figures to see how any changes to spending or budgeting would impact on their Surplus / Deficit over time, without effecting their current budget.

With the cashflow report, the Show Monthly Breakdown option must be set to Yes to display the monthly figures in the export. Once the report is opened in Excel, the Enable Editing option must be selected to enable the formula in the spreadsheet.

2. Chrome Performance

We have made some changes to Moneysoft to improve the performance when using Chrome as your preferred browser.

3. Search and List View for Practices

Administrators now have the ability to sort the practices and advisers in a list format. A search bar has also been added to permit the Practices or Advisers to be searched for using their business or adviser name. This functionality has been set-up similarly to how it already exists on the Individual Clients page.

4. Exporting a Previous Months Budget

We have improved the budget export feature to permit users to export the budget from any previous. Simply choose to view a previous month, then export. The budget will then display 12 months from the selected month onwards.

Posted 6 years ago by Moneysoft Sales 1 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more