The following release notes detail the updates and new features for Moneysoft PFM as of the latest versions:

Application Version: 3.0.20.20240405

SDK Version: 2.0.0 20240405

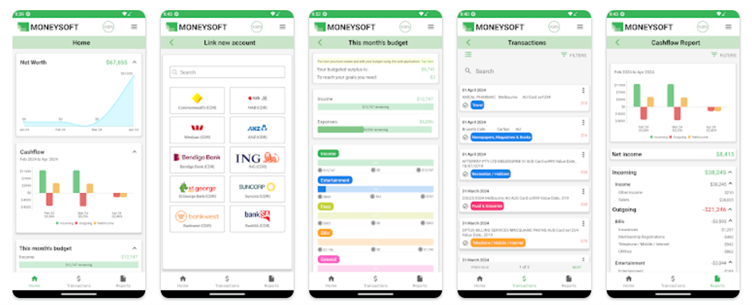

New Android App.

Ever thought of having your own company version of Moneysoft?

A new android app is now available on all Google app stores, which can be fully white labelled in your company name and logo.

The app will enable clients to link accounts via Open Banking as they can do now on the desktop version, as well as several other functions that will now be available under both environments.

And we have a new iOS (iPhone) app to follow soon, currently well into the build phase. We expect possible market release of this app within the next 1 – 2 months.

Please contact your Moneysoft Business Account Manager for more information on how we may be able to adapt Moneysoft to meet your specific business needs.

Open Banking Update

Consumer Data Right (CDR) data feeds on Moneysoft continue to expand, with most Moneysoft business account subscribers now able to offer this capability to their clients.

We have added an ‘Open Banking Data Feeds’ menu option to simplify adding linked financial accounts. With CDR data feeds, Internet banking passwords are not required, and clients may consent to share data for up to 365 days at a time.

Both Consumer Data Right (CDR) data feeds and Digital Data Capture (or “screen scraping”) feeds remain available to you and your clients. This is important, as not every account type is covered under the CDR legislation, and some institutions are still yet to be enabled for the service (most notably, superannuation funds).

For more information, visit ‘Open Banking’ on our website.

Watch this video, to register as a Trusted Adviser

And this video, shows how to connect to the CDR data feeds.

New Task List Feature

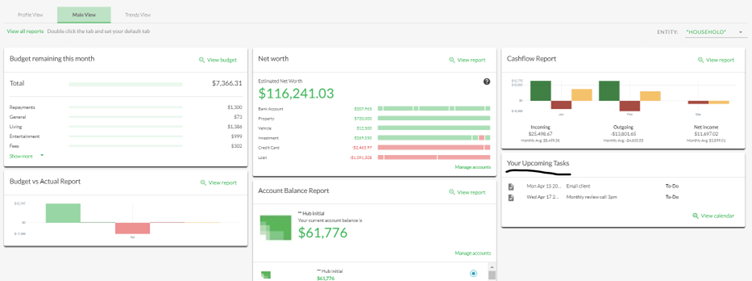

We have now included a handy task creation and alert feature in the Moneysoft calendar.

‘Your Upcoming Tasks’ is a new dashboard tile that displays tasks scheduled for the next three days.

If you set a reminder alert, this will trigger one day after the date of any incomplete tasks. Of course, the ability to add budget items remains, these can be set at the same time as setting tasks if you choose.

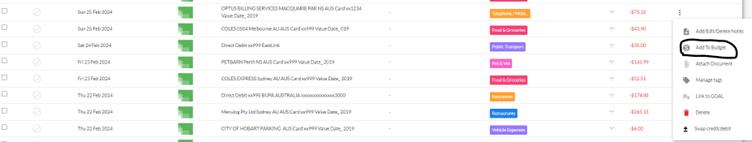

Adding Budget Items

And as a further enhancement, budget items can now be added directly from a transaction, via the ‘Options’ menu.

New ‘Goals Summary’ Report

A new ‘Goals Progress’ report has been added to the full suite, for all personal users and ‘Cash Flow Pro’ business client users.

Goals tracking information can now be presented separately as a standalone report, which we think is essential for effective money coaching.

General Software Improvements

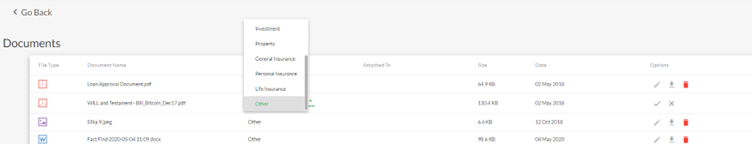

- We have redesigned our Fact Find modules, and the integration with X-Plan is currently in testing. Users can now store documents as a particular type – Investment, property, insurance type etc.

- For business clients, the Adviser's Profile Photo can be added in the ‘My Adviser’ Section and a photo for a ‘Household client’ will now display if this is added. We have also created a new version of the ‘Moneysoft Budget Planner’ document, which can be found under the ‘Resources’ tile in the ‘Admin’ page.

- The wording for some of our client alert emails has also been improved.

Some other notable bug fixes and improvements include:

- A webhooks issue that was delaying general refresh of account balance, and transactions has been resolved.

- A limit to the number of goals that can be set has been removed.

- Over budget, Exceed Category and Exceed Subcategory Alerts will trigger reliably and more than once in a month, as required.

- ‘Show Active Categories’ will now display in the budget, even if the amount spent is negative.

- The ‘Scheduled Goals’ timeline now displays the correct, exact number of months remaining.

- Manual accounts are now visible in 'Linked Accounts' on the client account page.

- Adviser access settings were tinkered with, so that temporary full administrator access can be granted at an adviser level, without business clients overall being incorrectly allocated at that level.

- The 'Net Worth' value shows correctly to include property in the client dashboard.

If you would like more detail on this or previous fixes, please get in touch with Moneysoft Support or contact your Account Manager.

Contact Information:

Phone 9:00am to 5pm EST: 1300 850 878

Support team: support@moneysoft.com.au

Accounts team: sales@moneysoft.com.au

Posted 22 months ago by Moneysoft Sales 4 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more