The following release notes relate to:

Application Version: 3.0.20.20230724

SDK Version: 3.0.20 20230724

Open Banking – Ready for Go-live!

Now only pending ACCC approval – we expect Open Banking data feeds to be live by 10 August 2023.

For any of you who are still not familiar with Open Banking (Consumer Data Right or “CDR”) and the benefits it will bring to you and your clients, please read our white paper on the subject here.

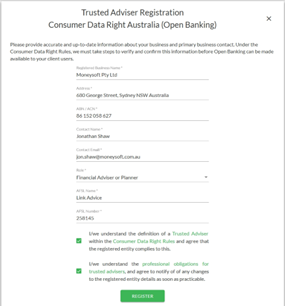

When Open Banking is switched on, you will need to register your “Trusted Adviser” entity details in accordance with the Consumer Data Right Rules, allowing your business and employees to gain access to clients’ CDR data. The Trusted Adviser registration process will be automatically displayed via a wizard process and can also be activated, viewed, or renewed (edited) via the ‘My account’ page in the Adviser Portal when logged in as the Administrator user.

We will put step-by-step guides and client-facing materials together for all business account customers when access to Open Banking data becomes available.

As a sneak preview, this is what you can expect to see soon:

Reporting Enhancements for Improved Client Management

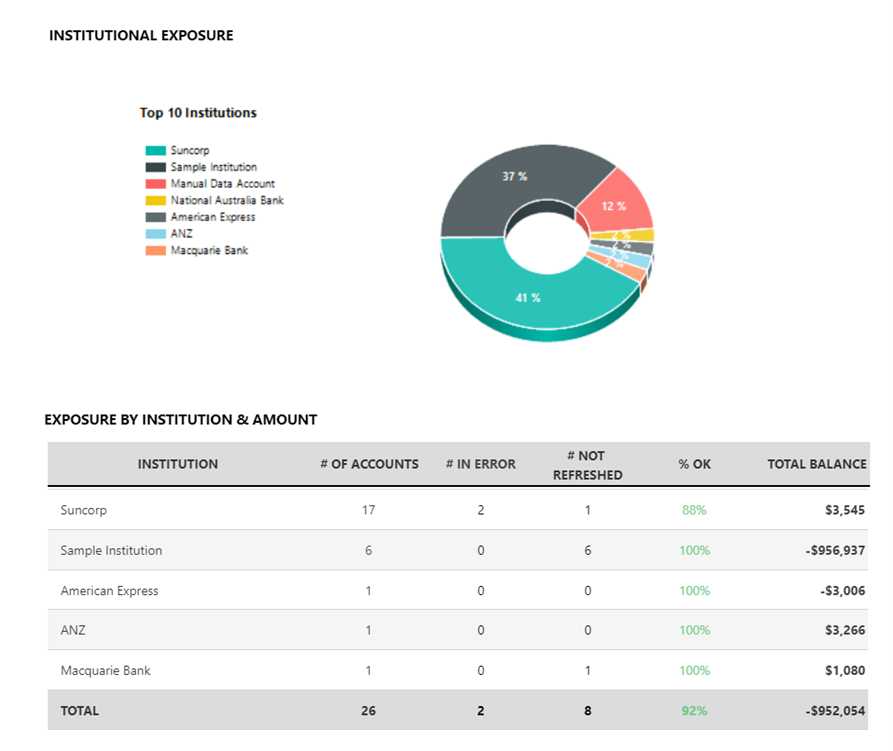

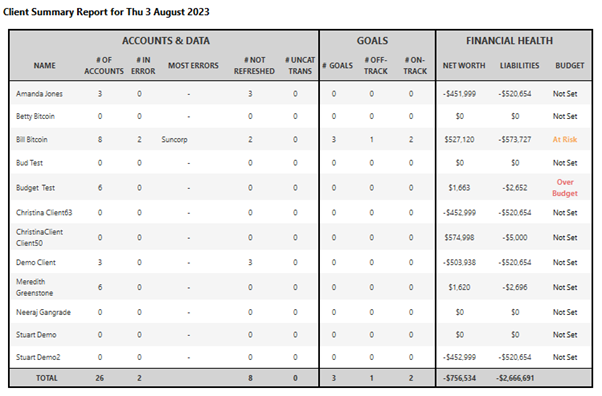

Carrying on from what’s been the norm for the last few months, we have made further improvements to reports, specifically the Institutional Exposure and Client Summary reports. Each of these client management reports now have improved overall insight and value. These reports are available via the Adviser Portal under the “ACROSS ADVISERS” or “ACROSS CLIENTS” tabs.

We have added more relevant information about linked institutions, the number of accounts refreshed and the number of accounts in error to the Institutional Exposure Report, as shown below.

Similarly, the Client Summary Report now contains much more relevant information, including general information about each client’s linked accounts, along with a snapshot of how clients are tracking towards their goals and key financial health indicators.

Performance fixes

There have also been more improvements made to performance and user experience this month. Some of you may have experienced a lengthy delay in loading the Dashboard when switching to view a client account from the Adviser Portal. This problem has now been rectified and all client accounts load as expected. In addition, a bug that was causing the dashboard to not display correctly for new client users has been fixed.

We also made some general improvements to the speed of several reports (including the Client Summary Report) during the month.

Other Fixes and Enhancements:

- Enhancement: There is more information in the ‘Site Upgrade’ tile. The optimum size required to upload a company logo to the Moneysoft Adviser Portal is now shown.

If you would like more detail on this or previous fixes, please get in touch with Moneysoft Support (support@moneysoft.com.au) or contact your Account Manager.

Posted 3 years ago by Moneysoft Sales 3 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more