The following release notes relate to;

Version: 3.0.16 20220518 and

SDK Version: 2.0.0 20220518

Moneysoft Fact Find | Xplan CRM is now available where Xplan two-factor authentication is enabled

To date, the Moneysoft Fact Find | Xplan CRM integration was only available to those businesses that did not have two-factor authentication (2FA) enabled on their Xplan site. We have developed an enhancement that means all practices can utilise the Moneysoft Fact Find | XPlan CRM integration regardless of whether 2FA is enabled or not.

To take advantage of the integration and setup the Moneysoft Fact Find | Xplan CRM integration, you can access the instructions guide from the following link here.

Budget ‘Net Summary’ tile enhancement

The Budget ‘Net Summary’ tile is a great tool to be able to determine whether a client has available cash flow to achieve any goals that are setup within their account.

However, in recognising that not all goals are being funded from the client’s regular budget and cash flow (e.g. Superannuation goals) we have now added an option so that any goal can be excluded from the Budget Net Summary tile.

This now means only the ‘minimum monthly contribution amount required’ for relevant goals will be included for the purpose of calculating the required monthly budget surplus and not all goal contribution amounts to achieve a more realistic client position.

To exclude a goal from the Net Summary tile, you can select the “Exclude from Net Summary” option when creating or editing a goal.

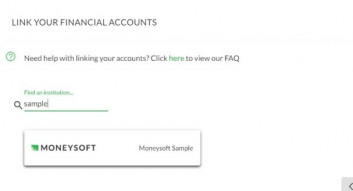

Moneysoft Sample Accounts now available

Due to a number of customer requests, we have added back the Moneysoft ‘Sample’ data accounts.

The sample accounts can be linked in the Moneysoft ‘Demo’ client (or any user) for the purposes of showcasing the software to clients with sample data. When the ‘Sample’ account is activated and linked, it will retrieve up to date transactions and allow you to generate reports using current data and information.

To get the up-to-date sample data, you need to follow the usual process for linking a financial account but search for ‘Sample’ in the institution field and then link the Moneysoft sample accounts. There are two types of sample accounts which include Bank and Loans and a good sample set of transactions.

Adviser accounts can now be deleted

Moneysoft account Administrators now have the option to self-serve and ‘Delete’ an Adviser registered account if an Adviser or Support Staff leaves the business or no longer requires access.

The delete option can be found by logging in as the Administrator, navigating to the ‘Individual Advisers’ tab and clicking on the menu icon for that adviser that you would like to delete.

Note: Any clients assigned to that adviser will need to either be assigned to another adviser or deleted/removed before the adviser account can be deleted.

Performance – Generate and Download Report Improvements

As part of our ongoing efforts to improve user experience, we have introduced a real-time application performance monitoring system. This has already helped us identify some major performance improvements and will continue to take advantage of the benefits of this with performance updates for all out customers.

In this release, we have made an improvement to the way the Account Balance report is generated. This has reduced the time it takes to generate and download an Account Balance report from several minutes (in some cases) to less than 20 seconds. As we continue to focus on optimisation of the software, there will be more improvements to overall speed and performance to come in future releases!

Other Fixes and Enhancements

A list of fixes and enhancements that have also been included in the latest software release are included below – if you would like more detail on any of these, please get in touch with Moneysoft Support or your Account Manager:

- Removed the requirement that ‘Notes’ require an entry in the text to be deleted

- Corrected an issue where the goal ‘progress bar’ was displaying the incorrect completion percentage for ‘Debt’ goals

- Fixed an issue where events in the budget calendar were displaying the incorrect day caused by daylight saving time differences.

- Removed the ‘Attachment’ Icon displayed in OTHER ACCOUNTS where there are no attachments against an account

- Fixed a minor issue where the incorrect transaction page was loading when searching through previous transaction pages and then filtering transactions

Posted 4 years ago by Moneysoft Sales 4 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more