1. Change Transaction Balance Signs

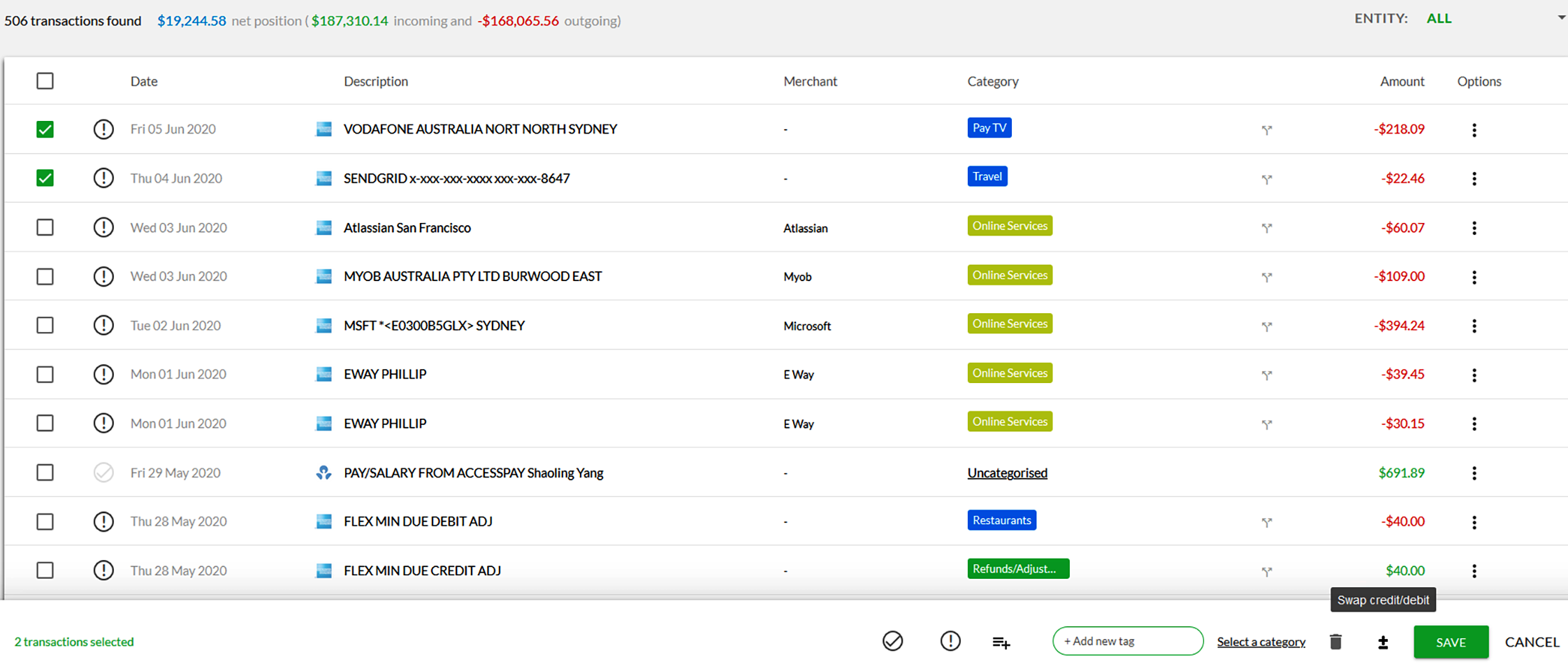

We have introduced a new feature allowing clients or their advisers to manually change the balance sign for transactions, where this data does not match the client’s expectations.

From the transactions page, select one or more transactions using the check boxes down the left side. Once selected, use the +/- icon in the bottom menu bar to immediately change the balance sign. Click Cancel to close the bottom menu bar once done.

Changing the balance sign may mean that they transaction categorisation will need to be updated to correctly reflect the transaction as either an expense or income category. All reports relying on transaction data will also be updated to reflect the change to the transactions balance sign.

Note, only existing transactions are effected by this change. Any future transactions will need to updated as they come in.

2. Budget Export Break

An issue where the Budget export as EXCEL WITH FORMULA was being created as an HTML File has been resolved. It will now once again correctly export to excel with the underlying formulae intact.

3. Adviser Access to Client Account set to Off by Default

We identified an issue whereby newly invited advised clients had their Adviser access to impersonate their accounts set to Off by default. This has been remedied so that all new clients will have this setting default to On as expected.

4. Deleting Properties not Updating the Net Worth

Deleting a properties was failing to update the Net Worth tile on the dashboard. The misbehaving properties have been located and removed, allowing an accurate net worth position to be correctly displayed on the client’s dashboard.

5. Deleted Entities Remaining

Deleted entities were refusing to take the hint and remove themselves from the client account, reappearing after the My Account page had been refreshed. This issue has been resolved and all deleted entities will no longer return unwanted.

6. Unnecessary Account Error Removed

New clients were receiving a error message informing them that their accounts could not be found, before they even linked any. This error message was non-sensical and has since been removed.

7. Updated Business Logo not Flowing through to Client Notification Emails

Updating a business logo from the Business Administrator’s, My Account page was failing to flow through to the client notification (alert) emails. This has been addressed, so that new business logos will now be correctly displayed in all instances where they are present.

8. Individual Client List Sort Function

The sorting function on the individual clients page has been repaired and will once again work allowing for the list to be sorted by each column.

Posted 6 years ago by Moneysoft Sales 2 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more