The following release notes relate to;

Version: 3.0.17 20220624 and

SDK Version: 2.0.0 20220624

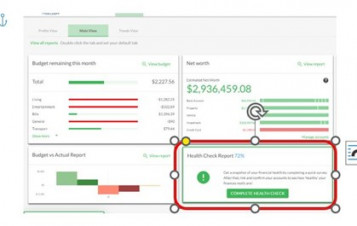

ENHANCEMENT – Health Check Report available for ‘Cash Flow Pro’ Users

The Financial Health Check questionnaire and report was designed as a quick and easy way to collect useful information from clients around their household finances. Previously this was only available for ‘Wealth Track’ users, we have now made this available to ‘Cash Flow Pro’ users as well. The questionnaire, if enabled, can now be accessed by users in the dashboard reports area.

Once the questionnaire is completed it will generate a Health Check report which will provides a score across four areas (Banking Structure, Budgeting, Balance Sheet and Benchmark Savings rate) as well as any specific areas or improvements to focus on.

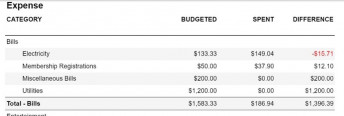

ENHANCEMENT – Budget vs Actual Report display

We have improved the Budget vs Actual Report by making it clearer when users are over their budgeted expenses, or under budgeted Income, by displaying those items in red. This will make it easier to quickly identify those categories that were outside the budget for the selected reporting period.

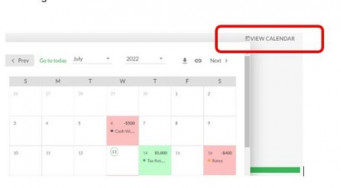

ENHANCEMENT – Budget Calendar editing “always on”

Further to the enhancement where we removed the requirement for a financial account to be linked, to be able to create a budget we have now extended this to the calendar. This change means you can now create and set a budget including adding any scheduled budgeted items to the calendar without the need for a financial account to be linked.

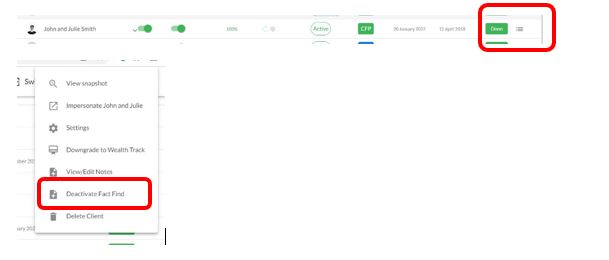

NEW - Option to ‘Deactivate’ Fact Find

We have added in the functionality to be able to deactivate the Fact Find for ‘Wealth Track’ and ‘Cash Flow Pro’ users. This means you can now use the digital Fact Find for initial data collection and then deactivate once this information is recorded or synced across to a third-party software such as Xplan or Midwinter.

To deactivate the Fact Find for a user, if you login into the adviser dashboard and select the menu option for that user, you will now see the option to ‘Deactivate Fact Find’ where the Fact Find has previously been enabled for that user.

BUG FIX – No more auto-log out!

We finally managed to find the “auto log-out” phantom that has been haunting some of you for quite a while now. It turns out this only occurred when logged in as an Adviser and impersonating multiple client accounts. As such, we have made an improvement to the way that the auto-logout timer keeps track of the multiple user sessions when impersonation is occurring. In very simple terms, the tracker was not being reset properly when switching back-and-forth between users during impersonation, and in some cases this would cause and unexpected log out from the software. We’ve found it and fixed it!

Other Fixes and Enhancements

A list of fixes and enhancements that have also been included in the latest software release are included below – if you would like more detail on any of these, please get in touch with Moneysoft Support or your Account Manager:

- Fixed an error in which goal editing became ‘locked’ in specific situations.

- Improved the wording in the ‘Account Error’ Alert notification to make it clearer how users can view and fix their account errors.

- Fixed an error in which the categories were not in order in the Budget Snapshot Report.

- Fixed an error where the profile percentage was not displaying in the admin/adviser dashboard

- Added a pop-up message when a client is ‘deleted’ or ‘removed’ from a business account to let the user know the action has been successfully completed.

Posted 4 years ago by Moneysoft Sales 3 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more