Release Notes for Build: 20210723

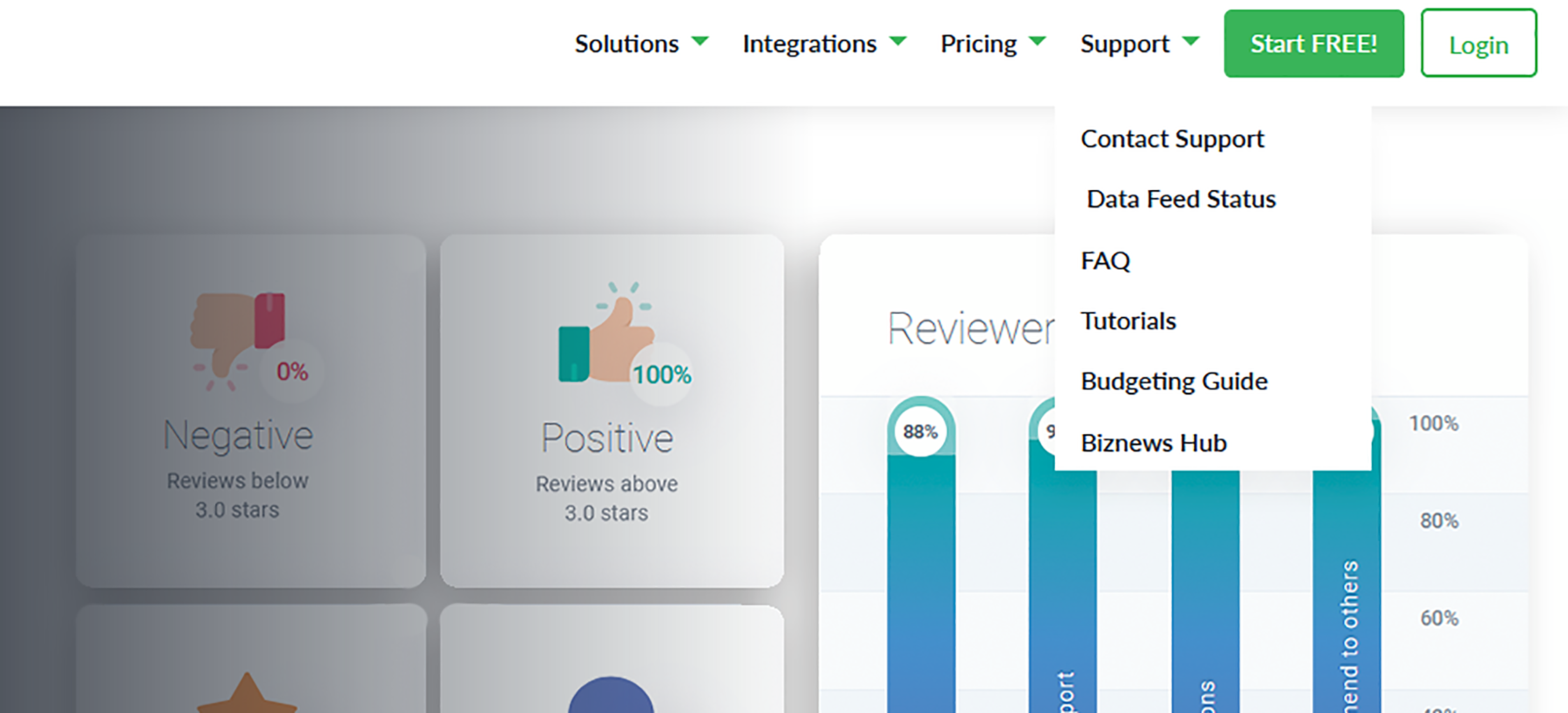

1. Data Feed Status

To provide you and your clients with extra information that may help with account linking or when accounts go into error we have added a new menu item to the Support tab on our website.

The Data Feed Status link will open a list of known financial institutions that are experiencing a higher than usual rate of failure due to issues beyond the client's control.

If you or your client are experiencing difficulties linking or refreshing financial accounts, we would recommend checking here first to see if it is a known issue that is already being worked on.

As mentioned the data feed status list is for issues beyond the client's control, such as when there a site technical errors or changes to the way the financial institution displays and manages information.

Please always check the error message displayed on the account tile first. The resolution for account errors related to incorrect credentials, responding to a request for more information with the financial institution, accepting updated terms and conditions, failure to enter secondary authentication in time, etc. will most often still lie with the client to take some action.

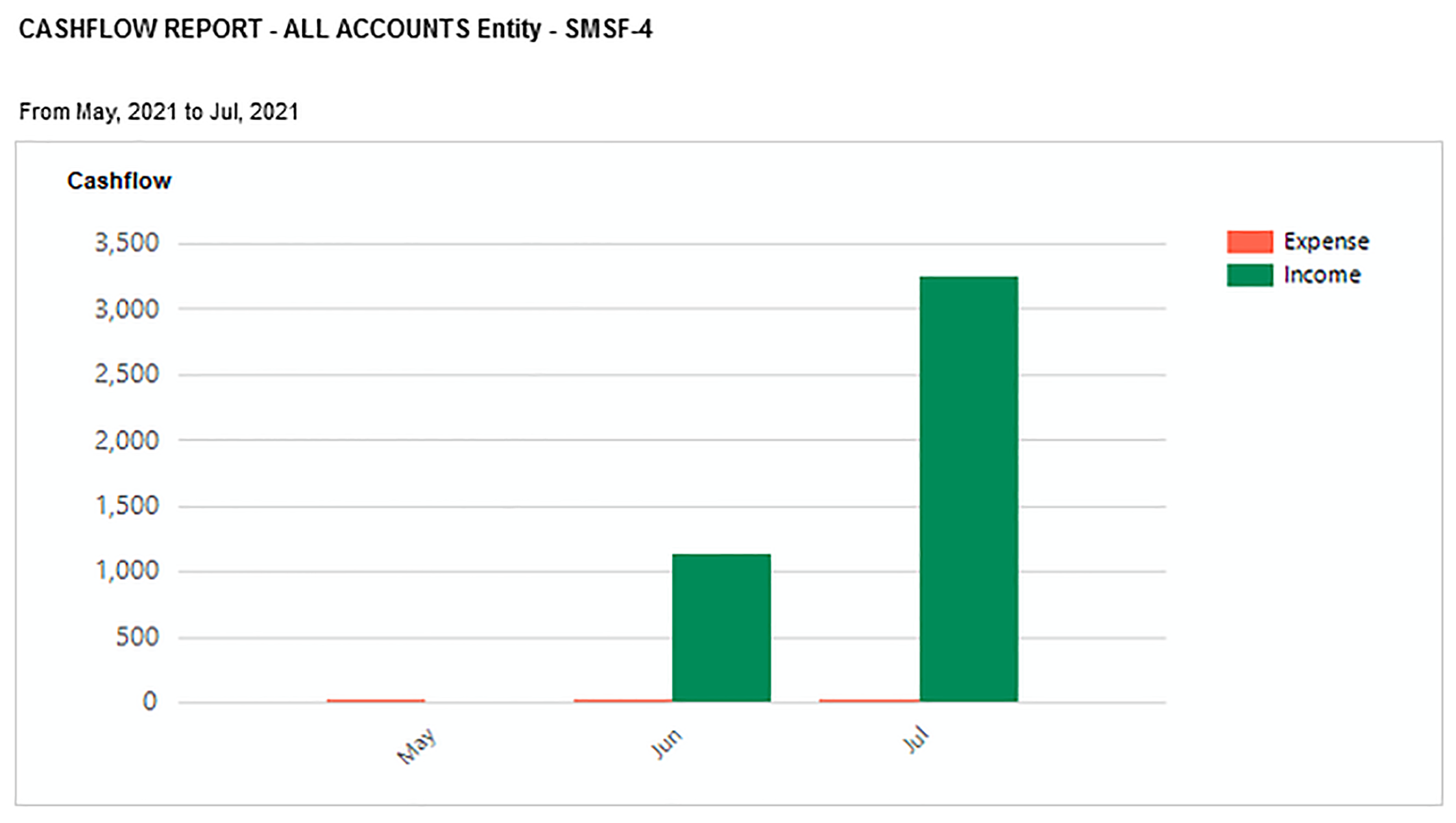

2. Entity Names Displayed on Reports

We received quite a few requests to make it easier to identify the entity a client report, such as the Expenses or Cash Flow report, was associated to.

Where an Entity is selected, that entities name will be displayed at the top of the report both on the screen and when exported as a PDF or Excel version.

3. Account Balance History Fixes

3. Account Balance History Fixes

In some cases, account balances are being supplied intermittently by the data provider’s system. This means that account balance history may show a single historical balance right up to the current date - for a period of around 40 days.

We have implemented a partial fix for this (the ultimate fix relies on the data provider) such that the current date's account balance will always be saved into the account balance history upon client log in or impersonation.

If and when the full account balance history becomes available from the data provider, the saved values will be replaced with the historical values supplied. As per our existing process, where an account balance is not available, the last known account balance will be carried forward until the next account balance is received.

4. Business Logo Improvement

You may have noticed that the business logo on the Moneysoft log in page can sometimes flicker between your business logo and the default Moneysoft logo. This is usually caused be minute delays in data being sent between our sever and your local computer. This delay will cause the default logo to be uploaded first and then once the business information is received the logo is updated.

To prevent this slightly annoying display issue from happening we have altered the order in which the data is sent though when your Moneysoft business site is accessed, meaning the logo load time is much faster.

5. New Client Report

We have developed a new report available to Business Admins and Advisers, called the Client List Report. This report can be accessed from the Across Advisers or Across Clients tab and provides a complete view of all your clients, their email addresses, product level, upgrade status and more. The report can be exported in either PDF or CSV formats and will make it easier for business administrators and advisers to view all their clients and current status in one easy to access report.

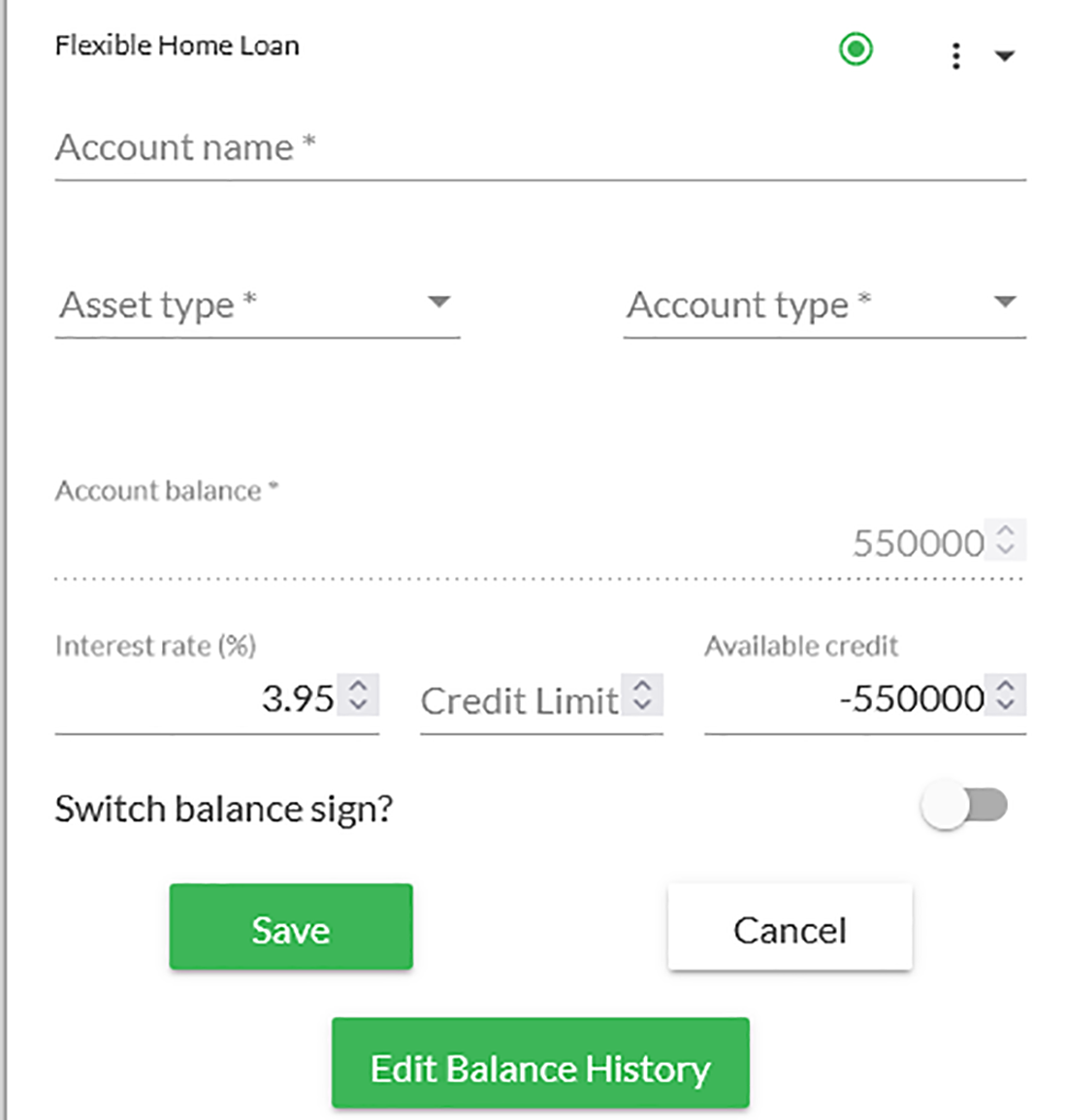

6. Interest Rate Data

|

You may have noticed previously that there is an interest rate field under the Account Settings option for linked financial accounts. Previously this field was only able to be populated manually, but under the new data provider system this field may be populated with interest rate data for Loan and Credit Card accounts automatically. This automated feature is only available where the data provider is able to access this information during their account data retrieval process and consequently is not present for every institution or Loan / Credit Card product offering. Over time we expect the data provider to increase its capacity to retrieve this information, offering you more information to help you service your clients. |

|

7. Demo Clients are Back

Demo clients had gone into hiding recently, but we have been able to track them down and return them to new business trial accounts. Furthermore they come with pre-loaded account data. We know that this data can become outdated fairly quickly and rather than us having to keep replacing this across all our business accounts, we have enabled the Manual Data Upload feature for the Sample Accounts so you can download the existing transactions, update the dates and the upload them back into the account should you wish to have recent transactional data.

|

Any business accounts that currently do not have a Demo Client present, who would like one, please contact us at support@moneysoft.com.au. Just a reminder that Demo clients cannot link financial accounts as they are not connected into our data provider. |

|

8. Manual Data Accounts Not Calculated Correctly in the Net Worth Report

An issue was identified where Manual Data Accounts were not being correctly recognised and calculated in the Net Worth report. This has now been rectified and all financial accounts are displaying their correct value and account type.

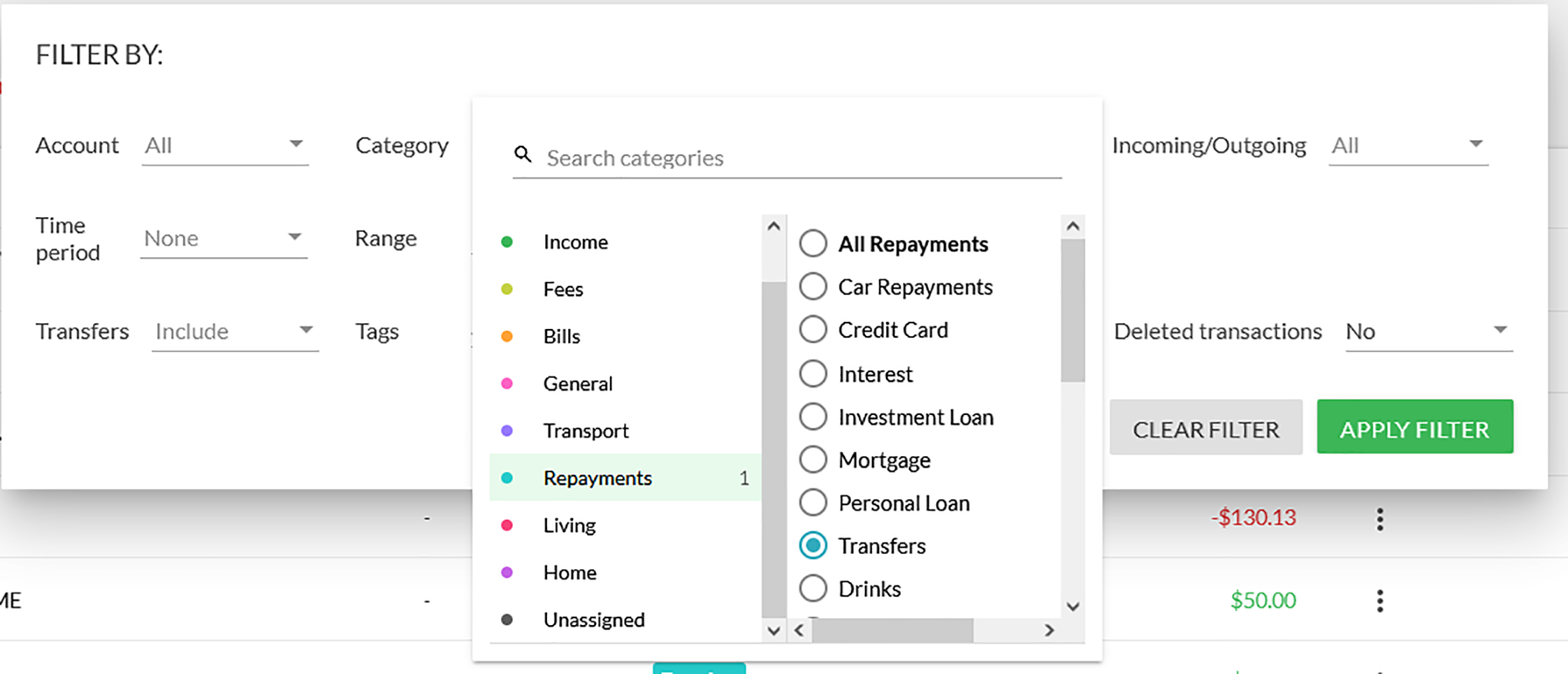

9. Improved Transactions Filter

We have improved the transactions filter to allow for Transfers to be filtered using the Category option in addition to the Transfers field.

10. Account Balance Only Feature

The issue causing the account balance feature to fail to operate as expected, preventing clients from setting accounts to Balance Only or from turning off this feature to view the account transactions, has been resolved.

11. Improved Account Information Display

We have improved the way that accounts are displayed on the My Account page and in the Account Balance tile on the dashboard.

On the My Account page, financial institutions that have some open and some closed accounts will have the closed accounts shown at the bottom of the institution tile. While financial institutions that have all their accounts closed will be moved to the bottom of the page.

The Account Balance tile on the dashboard will display closed accounts at the bottom of the list, with active accounts showing up the top.

Posted 5 years ago by Moneysoft Sales 6 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more