The following release notes relate to:

Application Version: 3.0.20.20230426

SDK Version: 3.0.20 20230426

Create client records in XPLAN from Moneysoft Fact Find data with just one click.

As part of our drive to help customers get the most from the efficiency and automation delivered by Moneysoft, we have invested heavily to improve our integration with Australia’s most widely used Financial Planning Software platform.

The most significant change is the ability to create client records in XPLAN from Moneysoft Fact Find data. This means you can get clients started quickly using Moneysoft’s fully customisable Fact Find, without the need to manually create client records in XPLAN first. Not only that, Moneysoft will do all the heavy lifting for you through one-click creation of the XPLAN client record, as well as full bi-directional data synchronisation of Moneysoft Fact Find data with XPLAN.

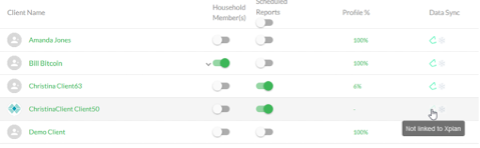

For any client that is not currently linked to XPLAN, follow the standard process, by clicking on the XPLAN Data Sync icon:

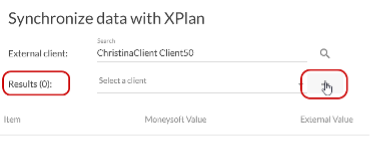

If your search for the client returns no results, you can create a new client record in XPLAN simply by clicking the icon to the right of the Results set:

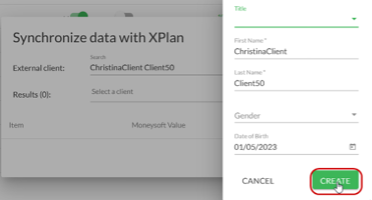

Then just fill in the client details and click “CREATE” to have your new client record automatically created in XPLAN, ready for full data synchronisation with Moneysoft:

In addition to this great new feature, we have significantly improved the single-sign-on integration with XPLAN, as well as adding new standard Fact Find modules including Superannuation Assets breakdown and Superannuation Contributions detail. If you haven’t had a look at our best-of-breed XPLAN integration yet, perhaps now is the time!

Discover New Accounts from Institutions that are already linked.

Sometimes we open new accounts with our banks and financial institutions, and this has always been difficult to handle in Moneysoft, after a bank or institution has already been linked to the system.

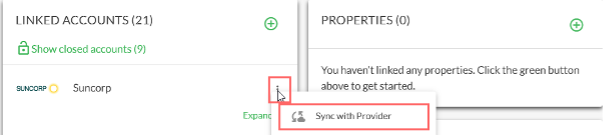

We’ve changed that now, and you can synchronise new accounts with Moneysoft with just a few clicks. You might notice a new menu next to each linked bank or institution listing. This menu brings you the “Sync with Provider” function which, when clicked, will search for any accounts with that institution that have not been linked to Moneysoft previously. This means you can now bring your Moneysoft system up to date, without having to link accounts all over again (and delete duplicate accounts etc).

Give it a try next time you or your clients open new accounts with a bank that is already linked to Moneysoft.

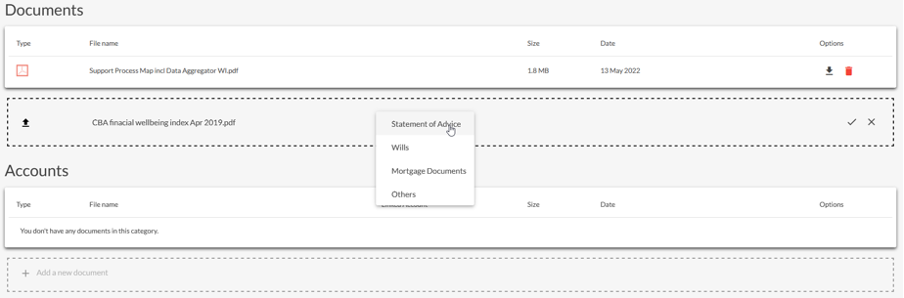

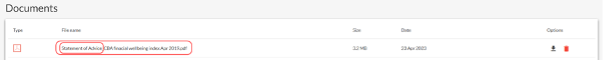

Document Type Tagging

When uploading a document to Moneysoft, it is now possible to select the Document Type from a drop-down list next to the document file name. After the Document Type (one of ‘Statement of Advice’, ‘Wills’, ‘Mortgage Documents’ or ‘Others’) is selected with entry saved and uploaded to Moneysoft, the Document Type will stay prefixed to the original document file name, allowing you to easily identify what the document was for in the first place.

Account Linking Status Indicators

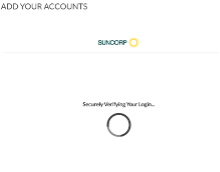

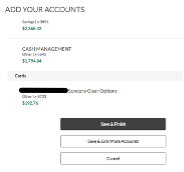

Sometimes when adding new Linked Financial Accounts in Moneysoft, it is not clear what stage the linking process is up to, or whether transactions have been retrieved. We have updated the account linking indicators to continue to display until the following two steps have both completed:

- Financial accounts discovered.

- Initial transaction set retrieved.

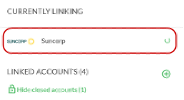

Your clients will now see a process flow that looks like as shown below. The ‘CURRENTLY LINKING’ spinner will continue to display until the first set of transactions are retrieved, even after the accounts have been discovered and are displayed in the Links Accounts list:

Adding Manual CSV Upload and Sample Data Accounts has changed.

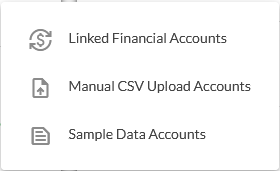

Adding Manual CSV Data accounts and Sample Accounts to a client profile has changed. Now, the option to add these types of accounts is available via the symbol at the top of the ‘Linked Accounts’ tiles in the ‘My Account’ section of the Client Portal.

Now, when you add to your Linked Accounts, you will see the menu shown below. You will choose which type of account to add from the get-go, without having to search.

Other Fixes and Enhancements

A list of other fixes and enhancements that have also been included in the latest software release are included below – if you would like more detail on any of these, please get in touch with Moneysoft Support or your Account Manager:

- Enhancement: “Wording update to Client Profile settings.” – wording to grant authorisation for Moneysoft account sharing to advisers and professionals has been changed to “Grant authorized users’ access to view, operate and support this {ServiceName} account."

- Performance: We have deployed some very big improvements to our rules processing engine which has improved the performance of the Moneysoft system significantly. Goodbye 3pm slowdowns. We continue to make good progress on performance improvements. Dashboard load times, you’re next!

- Bug: “Financial accounts linked via FastLink are not displaying in Net Worth Report” – our upgrade to enable Open Banking (known as FastLink) caused some issues with accounts displaying in the Net Worth report. This issue has been fixed.

- Bug: “Client and Adviser Notifications not working for some financial account alerts” – in some cases financial account alerts (such as Account Not Refreshed, or Account Error alerts) were not being fired correctly. This issue has been rectified.

- Bug: “Accounts and transactions sometime disappearing after a manual refresh” – there were cases of accounts “disappearing” from the Linked Accounts list after a manual refresh had been carried out. This bug was identified and squished!

- Bug: “Business Account (Partner) Admin Portal showing incorrect active user numbers” – the summary tiles in the Admin / Adviser Portal now displays the correct number of Active end users, in line our invoicing system.

- Bug: “Transaction Dates sometimes wrong on change of month” –related to our internationalisation of Moneysoft. Some older transactions which had been stored with incorrect timestamps, needed to be updated so they’d display correctly.

Posted 3 years ago by Moneysoft Sales 6 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more