The following release notes relate to:

Version: 3.0.20.20230310 and

SDK Version: 3.0.20 20230310

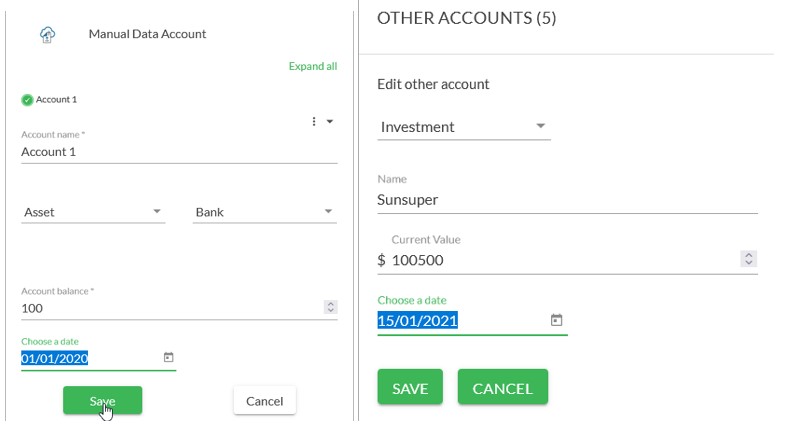

Full Balance History for Other accounts and Manual CSV Upload accounts

It is now possible to manually enter and report on historical balances for Manual Data Account and Other Accounts (of any type). The manually entered historical balances will take effect in the Net Worth Report, Account Balance Report and in Goals respectively. This is a very handy feature enhancement for manually maintained accounts and will allow you to create much more accurate reports for your clients. You can do this by editing the Settings for any Manual Data or Other account, then setting the Account Balance or Current Value to the desired amount, selecting the date you want that balance or value to take effect and clicking Save.

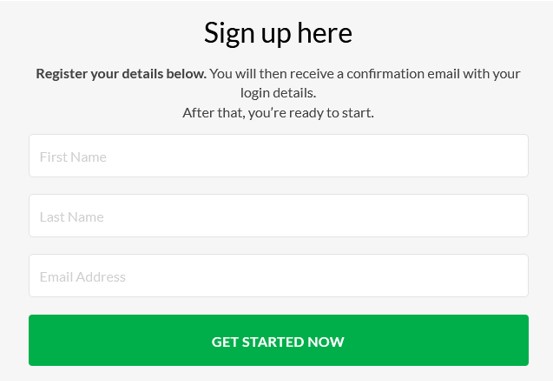

Client and Adviser registration embed code (HTML)

We now support HTML code that can be embedded in your own company website, allowing both Clients and Advisers to register directly within your private Moneysoft Business Account. This allows you to provide a nice-looking form within your own web pages for clients to register for your Moneysoft-backed services, instead of you having to manually send an invitation, client-by-client.

In other words, you can create your very own version of the sign-up form below, for clients AND advisers:

If you would like to know how to take advantage of this feature, please contact support@moneysoft.com.au

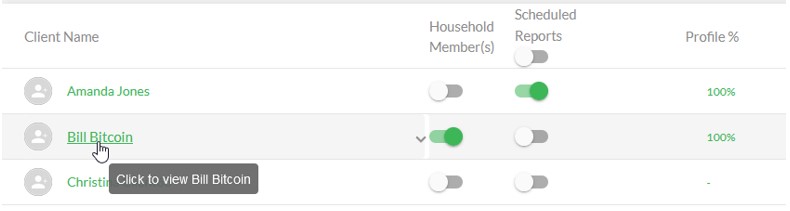

Click to Impersonate

It’s a small change in the greater scheme of things but it will make your life so much better! It is now possible to impersonate clients by clicking the client name (when viewing clients in List View mode).

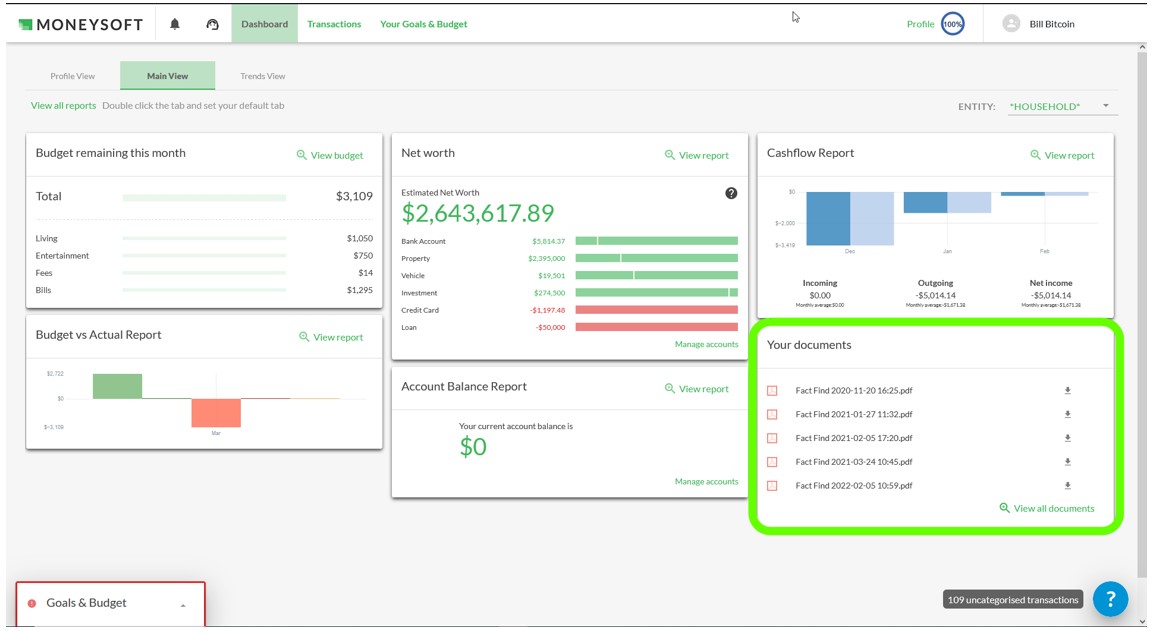

Documents Tile accessibility

We have made the Your Documents feature much more accessible and prominent in the main client Dashboard. Previously this tile was right at the bottom of all reports on the Dashboard, however it is one of the most commonly-used functions in the software. The Documents feature is still also accessible through the My Account section, but is not much easier to find directly on the Dashboard.

Scheduled Reporting with Household Members

Some maintenance was carried out on the Scheduled Reporting system, specifically in relation to handling of Household Members.

According to Moneysoft’s design, scheduled reports will only be sent to the Primary account holder, scheduled reports are not sent to Household Members (of course the Primary user can always share any reports they receive with household and family members).

If you would like to take advantage of our free report scheduling (“batch reporting”) capability, or if you’d like to explore the possibility or your own custom-developed report, you can request this by contacting support@moneysoft.com.au

Other Fixes and Enhancements

A list of other fixes and enhancements that have also been included in the latest software release are included below – if you would like more detail on any of these, please get in touch with Moneysoft Support or your Account Manager:

- Enhancement: Added the ability to recategorize multiple transactions when viewing transactions in the Transaction Notes section.

- Enhancement: Clicking on the Fact Find Profile % now returns the client to the Fact Find wizard when Profile % is less than 100%.

- Bug: “Cannot create a goal if Description text is too long” – the goal creation and editing process was updated to resolve this issue.

- Bug: “Changes to the budget not saving” – in some cases, especially for new clients, changes to the budget were not taking effect properly. This issue has been resolved and the budget roll-back feature has been enhanced as a result.

- Bug: “Closed accounts sometimes reactivating” – a hangover from the recent upgrade in preparation for Open Banking. This issue has been resolved and accounts marked as ‘Closed’ should no longer reactivate.

- Bug: “Enable Scheduled Reports button switching off automatically” – Fixed.

- Bug: “No error displayed when CVS upload fails” – Fixed.

- Performance: Major performance improvements were made to the Budget v Actual Report generation time

Posted 3 years ago by Moneysoft Sales 4 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more