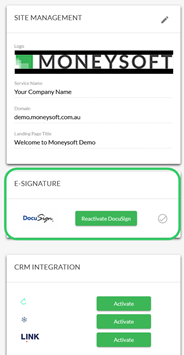

1. DocuSign Integration Available for all Practice Accounts

After some extra-special effort and collaboration between the DocuSign and Moneysoft engineering teams, your own DocuSign account can now be enabled and used within the Moneysoft web portal. Any practice that has a DocuSign account can easily integrate it with their Moneysoft practice account, and request client signatures directly through Moneysoft.

Just log in to your Moneysoft practice account as the Administrator and go to the My Account page. Look for the E-SIGNATURES tile just below SITE MANAGEMENT.

For more information on how to get going with DocuSign, see out FAQ here.

2. XPLAN Client Import Improvements

We recently identified and fixed a few issues relating to the importation of client records from Xplan, including partner details not appearing in the synchronisation table and new clients not appearing in the associated clients list. All Fact Find data will now successfully syncronise between the two systems – both on client setup/invitation and during subsequent data updates.

For more information on the XPLAN CRM integration, take a look at our guide and video here.

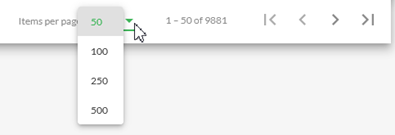

3. Transaction List View Extension

As a result of the recent performance improvements we’ve put in place, we can now provide a larger default transaction list view – which means less flipping through pages for you and your clients. The default number of transaction items per page has increased to 50, with pagination options increased to 50, 100, 250 and 500 items per page. We know this will make life much easier when viewing, exporting and editing client transactions.

4. Improved Custom Category Management

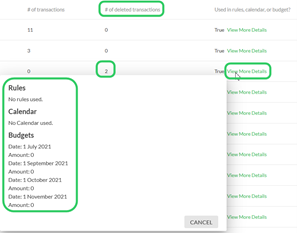

Ever wondered why you can’t delete an unwanted Custom Category? Ever been frustrated that it looks like you should be able to delete the category, but you still can’t? Well, we’ve finally put this one to rest.

Now when you MANAGE CUSTOM CATEGORIES, you can also see how many deleted transactions a custom category is used with (which will prevent deletion) as well as all of the detail about which rules, calendar entries and budgets the category is used in. No more guesswork. All of the information you need is right there so you can clear out all use of the custom category and get rid of it for good!

5. Security and Performance Upgrades

For the security-conscious, we have also implemented a huge upgrade to our underlying web interface libraries (we use a system called “AngularJS”). This upgrade brings Moneysoft up-to-date with the latest library versions, and also help improve user interface performance. You won’t *see* much of a change, so you’ll just have to trust us!

6. Other Fixes and Enhancements

Some other fixes and enhancements that have gone in over the past month are listed below – if you would like more detail on any of these, please get in touch with Moneysoft Support or your Account Manager:

- New credit card and account numbers for existing accounts are now reflected in the Moneysoft Linked Accounts list

- Added some mobile “responsive” enhancements so that the web interface renders better on mobile device web browsers

- Budget snapshot report now supports USA and AU timezones

- Fixed a rare error that could sometimes prevent Budget changes from saving correctly

- Downgrading clients from 'Wealth Track' to 'Auto Fact Find' now automatically activates the Fact Find modules

- Select account drop down list in Cashflow Report is now correctly aligned

- Rules filter has been fixed (previously this was not working)

Posted 4 years ago by Moneysoft Sales 3 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more