1. Investment Account Holdings Data

A much anticipated new feature has just been added to Moneysoft… Investment account holdings data.

|

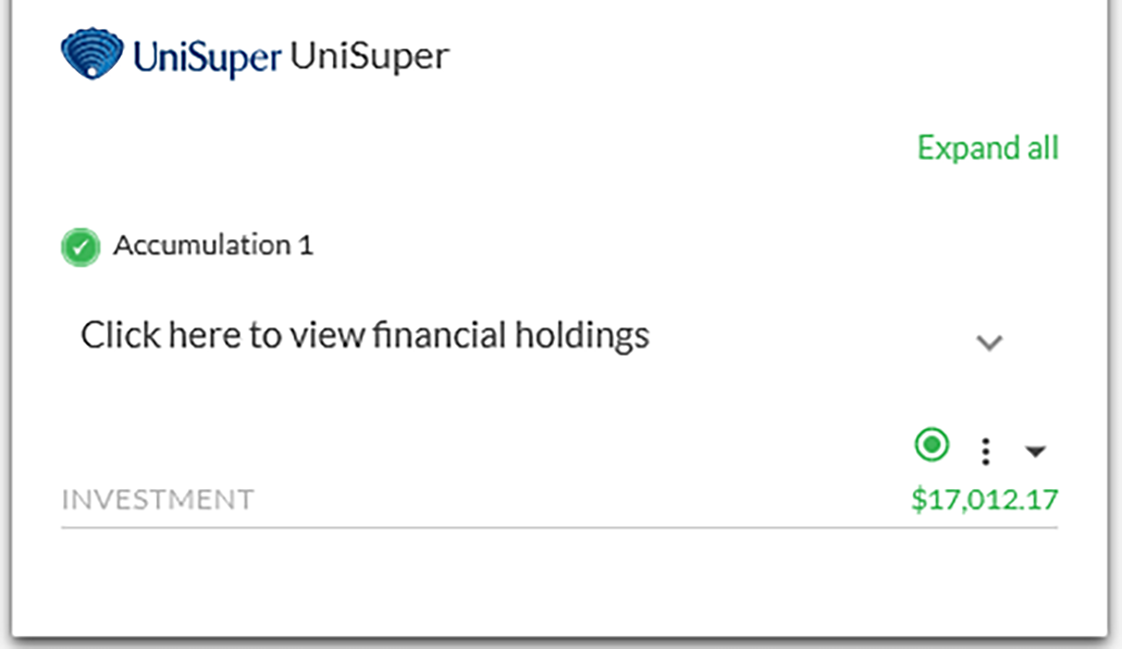

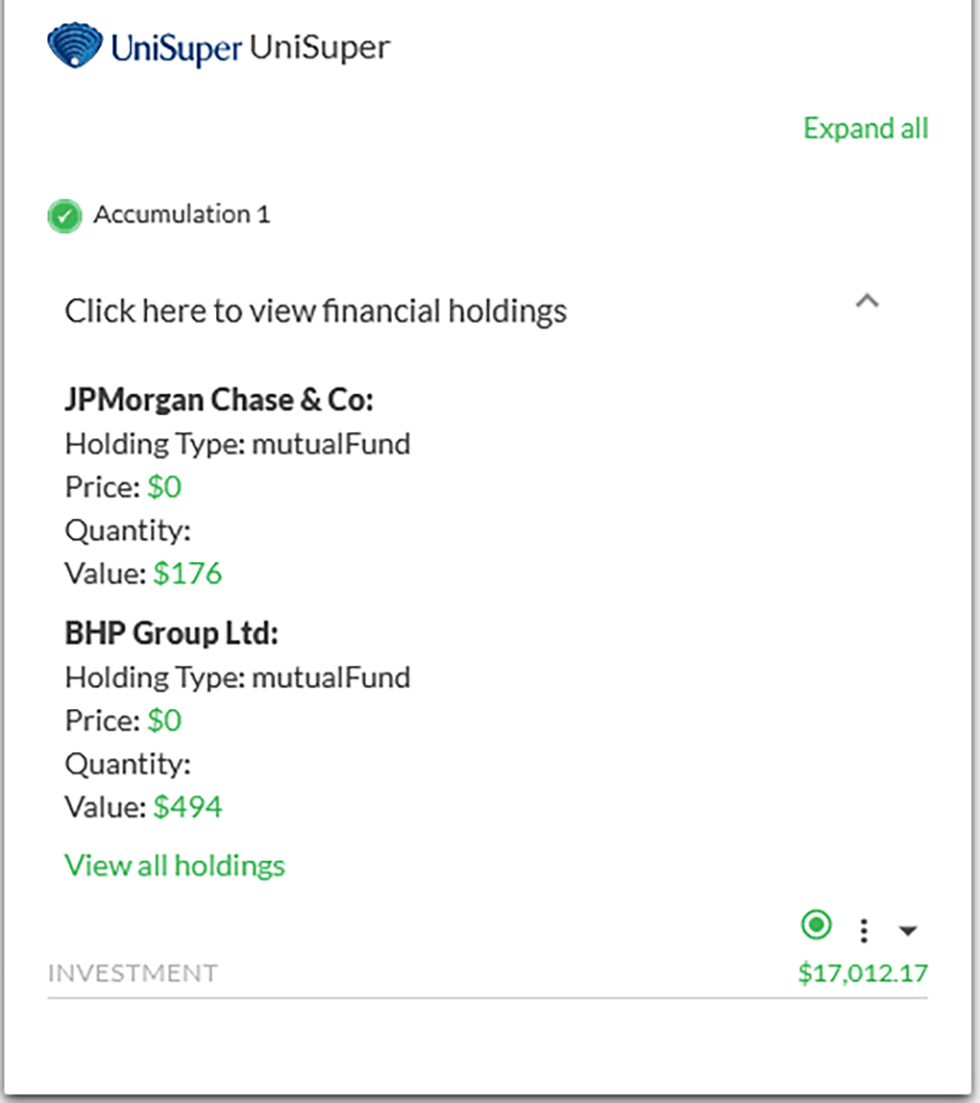

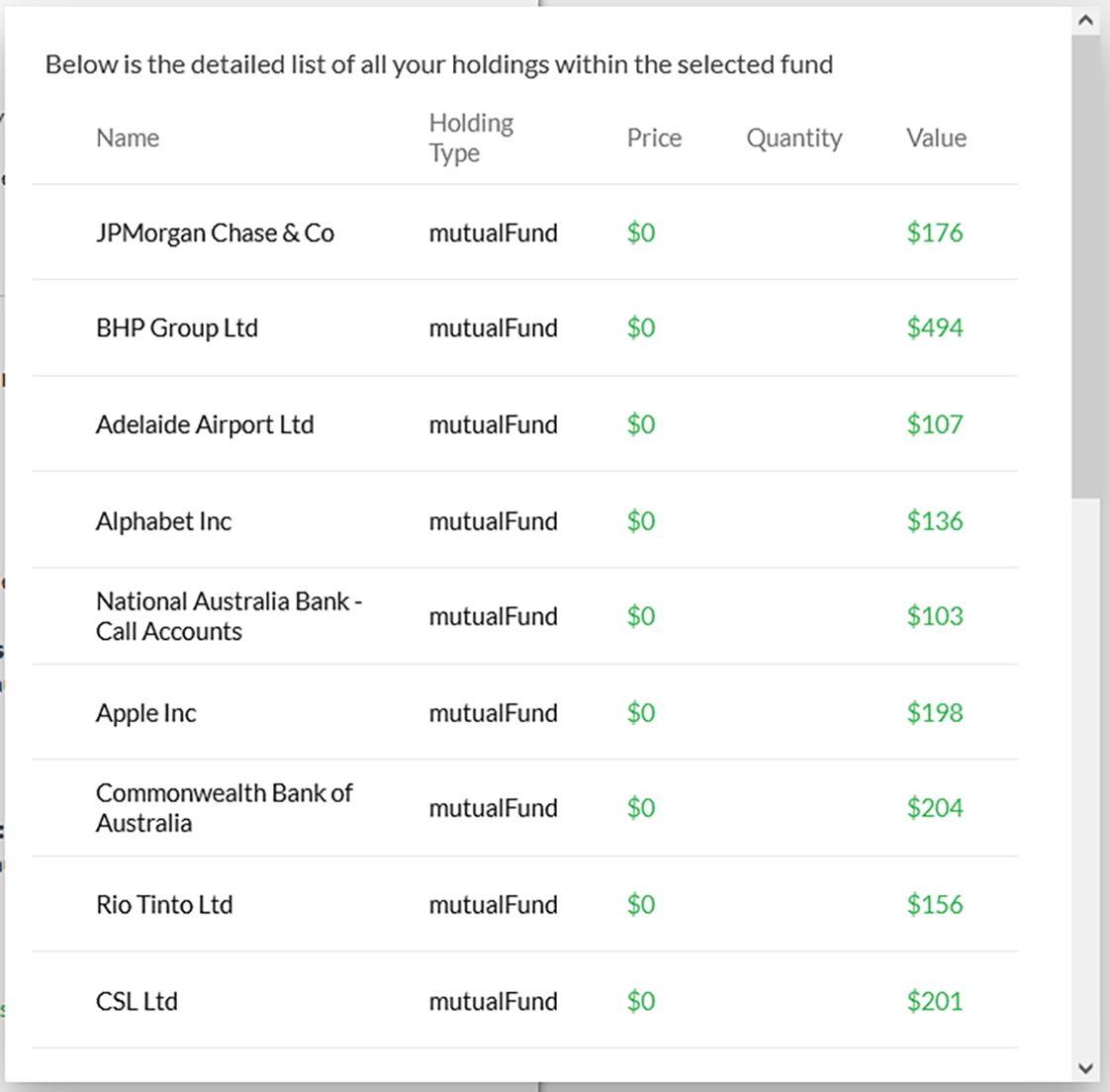

Holdings data is now available for both new and existing investment accounts, where it is available from the data provider. Simply click on the down arrow at the end of Click here to view financial holding to view the holdings data. The first two results will be displayed by default. Where more information is available, a View all holdings link will be displayed at the bottom of the list. Clicking on this will open a new pop-up window displaying all available holdings data for the account. |

|

|

|

|

2. Improved Dashboard and Page Loading Time

The team have been very busy of late reviewing and improving the way that data is retrieved and loaded into Moneysoft when you log in or impersonate client accounts. This has lead to a number of improvements in the background, which have substantially increased the load time for all pages, and most notably the client dashboard and transactions page.

3. Background Financial Account Refreshing

With the initial upgrade the new data provider system all but completed, we have been able to spend some time on implementing the background refresh of financial accounts – Webhooks. This implementation means that it is no longer necessary for clients or their advisers to log in to or impersonate their accounts for the most recent financial account balances and transactions to be retrieved.

4. Two-factor Authentication for Moneysoft

Given the increased awareness around cyber security, Two-factor authentication (via SMS) has been extended to Moneysoft web and mobile applications access as an optional feature. Two-factor authentication (via SMS) can enabled for any PFM business account upon request by emailing sales@moneysoft.com.au.

5. Two-factor Authentication for XPlan

Previously the Moneysoft Fact Find | Xplan Integration was only available where two-factor authentication was not enabled on the practices Xplan site. Moneysoft has implemented and extended the Moneysoft structure to allow both Xplan basic authentication and OAuth (2FA) to co-exist in Moneysoft.

If you would like to setup the Moneysoft | Xplan Integration and your practice has two-factor authentication enabled on your Xplan site, please email support@moneysoft.com.au to arrange for this to be made available.

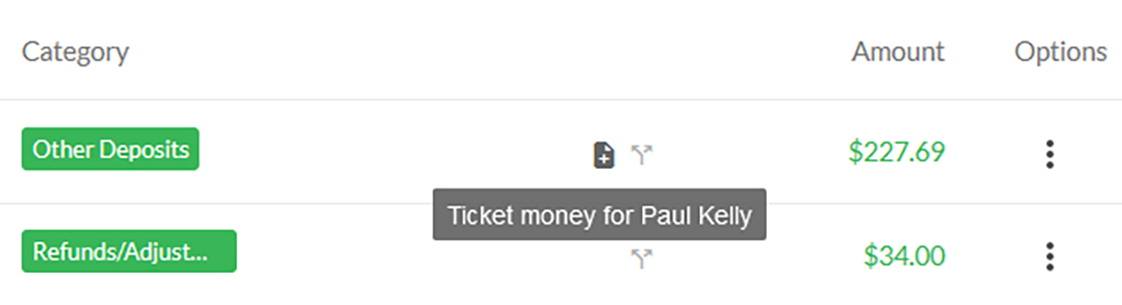

6. Transactions Notes Improvements

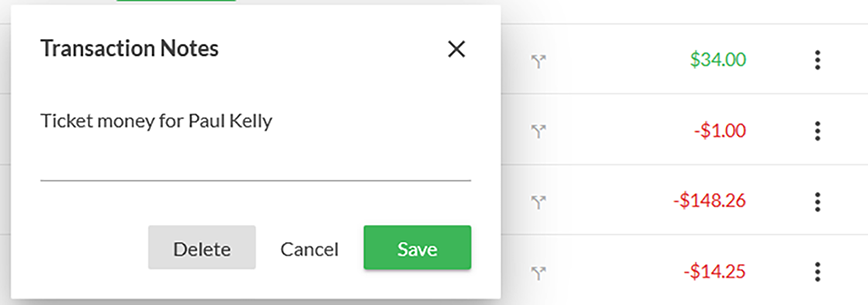

We have made some minor, but useful improvements to Transactions. Firstly it is now possible to delete a transactions note from the transactions page… you will no longer have to go into the Transactions Notes module on the My Account page for this options.

Secondly we have added a mouseover feature to allow you to read the transaction note without having to open it.

|

|

|

7. Transactions Categorisations Issues

We have recently observed that transactions were losing their categorisation after being and in some cases their description as well. We were able to trace this back to an issue with the information we were receiving from the data provider.

We have implemented some changes on our side to manage any unexpected data changes to protect recategorised transactions and transaction descriptions. This is in place for any new transactions and we will continue to work to restore any transactions that were previously impacted.

Posted 4 years ago by Moneysoft Sales 3 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more