1. Household Member Feature is live!

The new Household Member Feature is now live in the software and available within all Business Accounts. Through your Business Account administrator or adviser login, this feature will allow you to activate the Household Member Feature for specific clients. When active, you or the primary client can then invite a household member to share access to the primary client account.

Household members will be able to login to the primary client account via a unique username and password, and will be able to view and update in the same way as the primary client, however, financial accounts, properties and other accounts can only be edited, unlinked, closed, etc. by the household member or primary client that linked them.

For more information on household members and how they operate please see the new FAQs on our website.

2. Upgrade Status Improvement

To remove any possible confusion around which clients have upgraded and those who are still to start or finish, we have updated the Upgrade Status for clients invited after the business account was moved to the new data provider system as well for demo clients to show as Done, rather than None.

3. Configure Your Client View

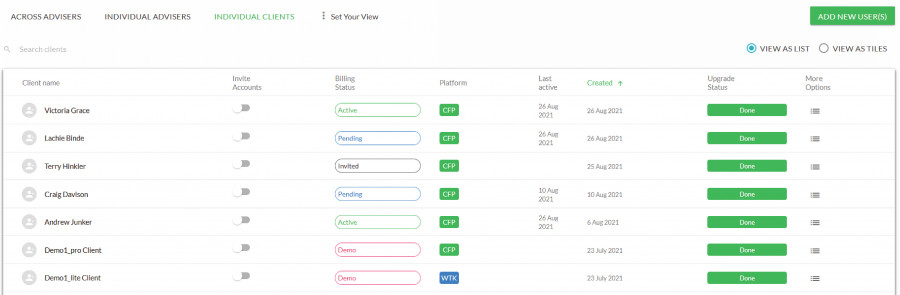

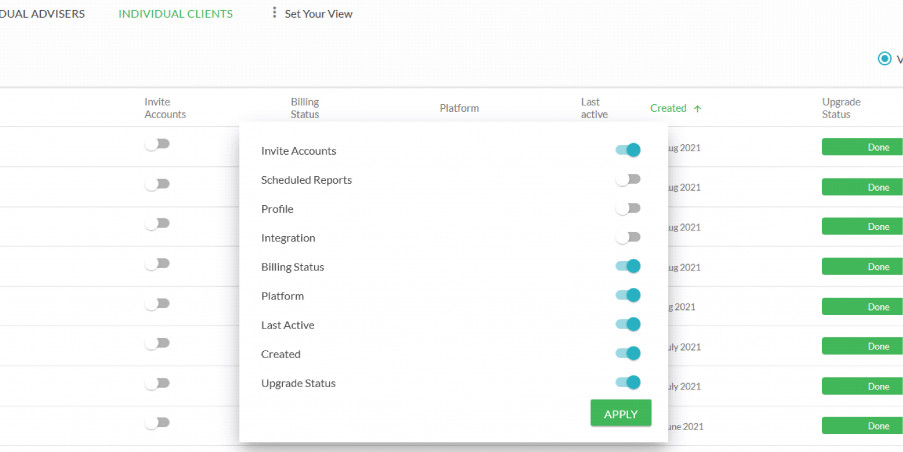

We have added a new feature to permit business administrators and advisers to configure the Individual Client page view.

Click on the Set Your View button at the top of screen, use the sliders to turn the options on or off then click Apply. Any changes made to the list or tile view will flow through to the other.

4. Improved Financial Account Display

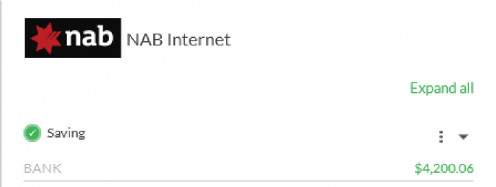

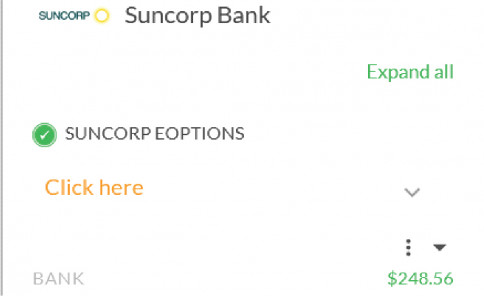

We have improved the way financial accounts are displayed on the My Account page to make it easier to see their status with just a glance.

Accounts that are not in error will show a green tick mark beside the

|

Accounts that are not in error will show a green tick mark beside the account name. |

|

|

Accounts that are not in error but have not refreshed within the last seven days, will also have a green tick mark but will also have an orange Click Here with instructions on what to do get the account refreshing again. |

|

|

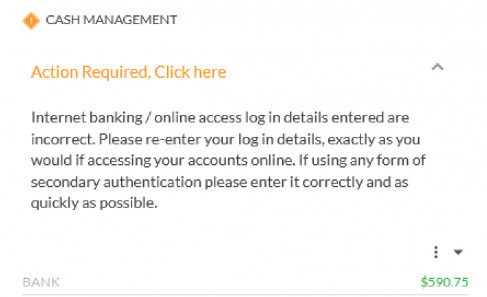

Accounts that are in error that require client intervention to get operating again, such as Incorrect Credentials, Expired Token Code, Accept Updated T&Cs, Account Locked, etc., will have an orange caution icon and an orange text saying Action Required, Click Here with instructions on what to do get the account refreshing again. |

|

|

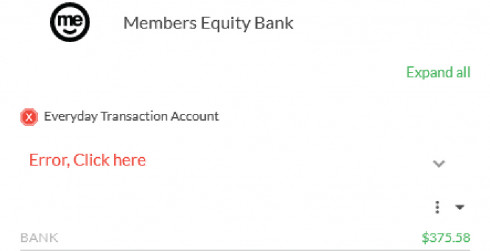

Accounts that in error that require Support to assist with resolving the issue will have a red stop sign icon and red text saying Error, Click Here with instructions to on what to do next to resolve the error. |

|

5. Hide / Show Closed Accounts on the My Account Page

|

For those who don’t like their closed accounts cluttering up their My Account page, we have added a new feature to Hide / Show closed accounts. Click on the three dot options menu beside the Linked Account heading to access this new feature. |

|

6. Transactions Export Enhancement

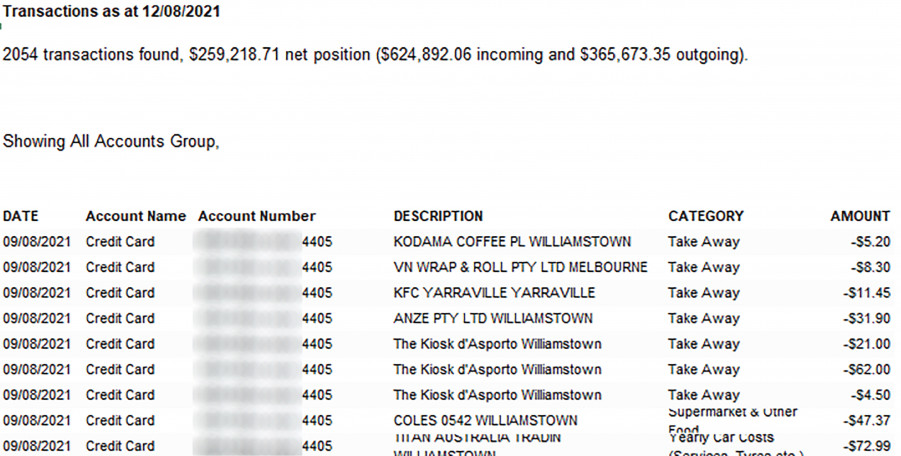

To make it easier to identify the accounts associated to the transactions in the exported report, we have added the Account Name and Account Number columns to the exported report.

7. Upgrade Wizard Improvements

While it won’t be obvious from the outside, we have made a number of changes in the background to improve the success rate for a number of financial institutions going through the upgrade wizard. This will mainly impact financial institutions that were timing out during the upgrade causing partial or complete upgrade failures.

We also returned the Cancel option for clients so that they may review their financial accounts and close any that are no longer required before going through the upgrade process.

8. Business Custom Categories, Rules and Report Settings Not Applying for New Clients

The issue that was impacting some business accounts causing business specific custom categories, rules and report settings to not be applied has been resolved.

9. Merchant Name Not Saving

We have fixed an issue where the Merchant Name was not saving after logging out and back into your Moneysoft PFM account.

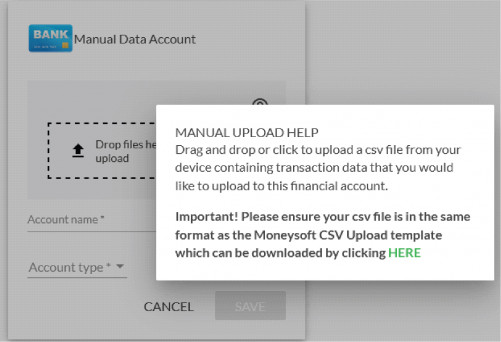

10. Manual Account Help Link Is Back

|

The ? icon on the Manual Data Account linking tile is once again opening up the help dialogue for anyone who may need it. |

|

Posted 4 years ago by Moneysoft Sales 4 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more