The following release notes relate to:

Application Version: 3.0.20.20230703

SDK Version: 3.0.20 20230703

Account Linking System Upgrade

We have now upgraded all business accounts, clients, and personal users to the latest Account Linking technology. This is the final step of upgrades before rolling out Open Banking data feed access to all users. For any of you who are still not familiar with Open Banking and the benefits it will bring to you and your clients, please read our white paper on the subject, here.

When adding accounts that are linked to a bank, the system will very quickly discover all accounts at the institution site, and then display the institution as “Currently Updating” in the Linked Accounts list until all transaction data has been retrieved, or after 24 hours has passed, whichever is sooner.

Some further improvements were made to the way in which Manual Data Account (and Other Accounts) balance history can be entered and managed, and a couple of bug fixes implemented to improve the experience around general management of accounts (in particular, Closing and Deleting accounts).

Email System Upgrade

Some customers and clients reported issues with Invitations, Alerts and Reports not being sent or received via email. Checks on our system revealed some of the reasons why – one of which is because (unknown to us) other companies using the same emailing system have been engaging in spamming activities. This meant our emailing system was sometimes being blocked. We have now upgraded the system and you should see Alert and Report emails coming through much more reliably from here on.

Reports Enhancements

We’ve been doing a lot of work on the Reports lately and there’s a number of updates that have been released over the past couple of months:

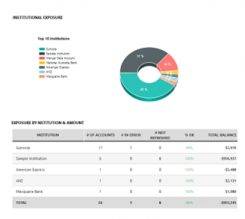

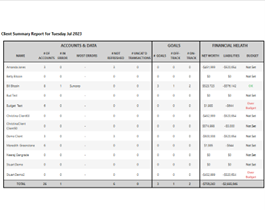

Institution Exposure Report and Client Summary Report

We have had a number of requests from customers to provide a more efficient way of identifying which accounts are in error and which clients are affected. To achieve this we have made some huge improvements to the Institution Exposure Report and the Client Summary Report, both of which can be found in the Adviser Portal, under the “ACROSS ADVISERS” tab (for Admins) or under the “ACROSS CLIENTS” tab for Adviser users.

The Institution Exposure Report helps you easily identify which banks and institution data feeds are likely to be in error or not working well, and the Client Summary Report helps you easily identify which clients are affected by the any data feed issues, along with several other KPIs related to management of your client base.

Account Balance Report

Not only have we improved the speed of this report, we have also added the option to run the report including Properties and Other Accounts as well. This means you can now check the full balance history of absolutely any account, via the Account Balance Report. There were also a few minor bugs fixed that will improve the general historical accuracy of the report and data.

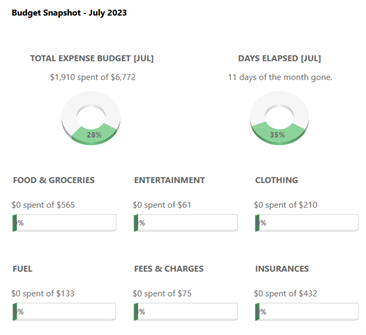

Budget Snapshot Report

The Budget Snapshot Report has been updated in several way, firstly by extending the number of categories that can be included in the Snapshot to six (6). The report has also been visually enhanced, along with some speed improvements and persistent memory of the last set of categories that were selected for each client on the previous report run.

Transactions Page Enhancements

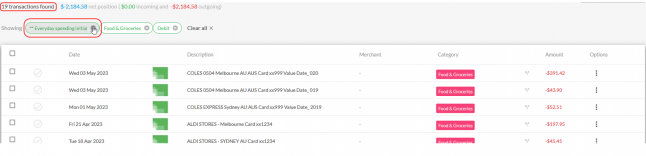

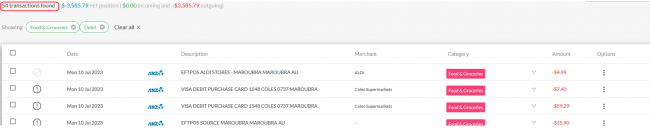

Some usability improvements have been added to the Transactions page, in addition to recent improvements made to the functions available on the Transactions page view, we have now also enhanced a few other aspects:

Filter: The Filter function now shows all conditions of the Filter as discreet items, which allows the user to remove Filter conditions one-by-one, and re-add different conditions on the fly. An example is shown below:

Export: The Transactions export function will now include the institution information as part of the exported data.

Re-categorisation: The re-categorisation window is now anchored to the centre of the Transactions page, which ensures it is always visible on any device.

Other Fixes and Enhancements

A list of other fixes and enhancements that have also been included in the latest software release are included below – if you would like more detail on any of these, please get in touch with Moneysoft Support or your Account Manager:

- Enhancement: Rules view now includes a “Date Created” and “Date Modified” column to provide more information about when each rule was put into effect

- Enhancement: Some improvements has been made to Goals so that any contributions that are made by linking Transactions now retains the transaction description and debit or credit status of the contribution

- Performance: Dashboard load, rules processing, account data processing

- Bug: In some cases, clients and advisers were not receiving email alerts. We have updated the trigger conditions for some alerts and combined with the system upgrade mentioned earlier, this problem is now resolved

- Bug: It is now possible to Close and / or Delete linked financial accounts in Moneysoft, even if the corresponding account record does not exist at the wholesale data provider’s site.

Posted 3 years ago by Moneysoft Sales 5 Minute(s) to read

Most Popular

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 8 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 8 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 8 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read more